This article was originally published in the Brand Finance Football 50 2025 report

Manager,

Sports Services,

Brand Finance

In today’s hyper-connected world, sport is no longer confined to the pitch. Football is more than a sport - it’s a global cultural phenomenon, a multi-billion-dollar industry, and a deeply personal passion for billions of fans. But what truly drives fan loyalty in today’s hyper-connected world? Drawing on global survey data from Brand Finance conducted in June 2025, we dive into the heart of football fandom to uncover what supporters really care about - and what that means for clubs, leagues, and brands seeking to earn their devotion.

Sports fan engagement across markets

Whilst some football leagues, notably Europe’s Top 5, command truly global audiences, many only have a strong appeal to their domestic market. At the top end, the Premier League generates 44% of its total broadcast income from domestic broadcasters, whilst this rises to 89% for Ligue 1. On average, throughout these Top 5 leagues, 70% of broadcast revenue is generated through domestic deals, whilst a much higher proportion is exhibited through other sports leagues. Fan engagement with sports leagues varies significantly across Europe, revealing both cultural preferences and market dynamics.

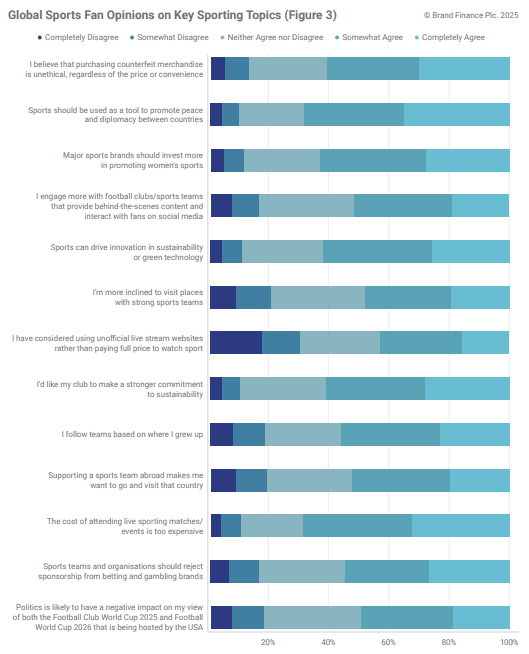

The top 5 domestic football leagues in Europe exhibit some of the highest engagement levels by sports fans. Premier League and Bundesliga fans are among the most engaged, with 83% and 84% watching matches on TV respectively. On average across Europe, 60% of football fans have watched behind the scenes content, 41% have bought merchandise, and almost 48% have placed a bet on the league in the past year.

The surprise exception is Bundesliga fans, who demonstrate noticeably less in engaging with the sport apart from watching matches. This is much higher than European Formula 1 fans, where only 69% have watched a race live in the past year, 43% have watched behind the scenes content, and only 22% have bought merchandise. Part of the difference here can be attributed to the increasing number of football matches that are broadcasted far more regularly than motorsports events.

However, followers of the tennis ATP tennis tour, which has similar broadcast coverage to the Premier League, have a significantly lower engagement rate (only 54% watching live matches in the past 12 months). These differences highlight the need for tailored engagement strategies, with clubs in some markets focusing on digital content and others investing in matchday experiences to deepen fan loyalty.

Social media as a football engagement channel

Social media has become an essential platform for football clubs and leagues to engage with fans in real time, build global communities, and humanise their brands. That said, engagement levels vary dramatically by region. In emerging markets like the UAE, Saudi Arabia, India, and China, fans are highly active in relation to the Premier League – with more than two thirds following the league and respective teams on social media.

In contrast, fans in Western Europe are more reserved, with only 48% of Premier League fans following the league or participating teams on social media. These regional differences highlight the need for tailored digital strategies. In order to maximise engagement, rightsholders need to know which markets crave behind-the-scenes access and star power versus others may respond better to tradition and match-focused content.

Emerging attitudes towards merchandising options

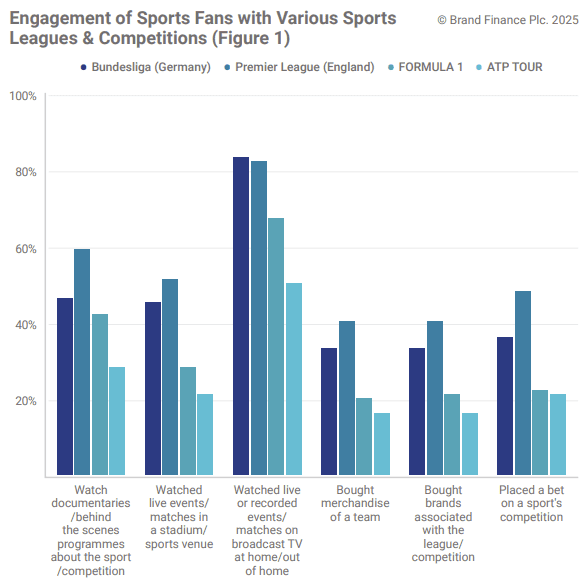

When it comes to merchandise pricing, fans across Europe show strikingly different attitudes. Ligue 1 supporters are the most accepting of high prices, with almost 60% responding that merchandise is expensive but justified. While LALIGA, Serie A and Premier League followers strike a middle ground, Bundesliga fans lean toward value-consciousness, with many seeing merchandise as either a bargain or too cheap to trust.

Sophisticated rightsholders should use this type of market understanding to shape their product offering and pricing strategies to simultaneously protect their brands while securing the most value. This is becoming increasingly important given the widespread purchase of unofficial or counterfeit football merchandise, which poses reputational and financial challenges for clubs and leagues.

According to Brand Finance research, 40% of football fans admit to having bought unofficial merchandise associated with their favourite club. The issue is particularly acute in LALIGA, where half of respondents have done so, followed by the Bundesliga (46%), Serie A (44%), Premier League (39%), and Ligue 1 (38%).

Demographic data shows the trend is equally widespread across age and income bands. This thriving grey market undermines official licensing revenues, dilutes brand value, and complicates efforts to maintain quality control and ethical production standards. For clubs, it’s not just about lost sales – it’s about losing control of the fan experience.

Addressing this issue requires a mix of pricing strategy, product innovation, and fan education to shift perceptions and bring more supporters into the official fold. Research like this can complement data on seized counterfeit goods to help rights-holders understand the scale of the problem, but additionally how to go about solving it.

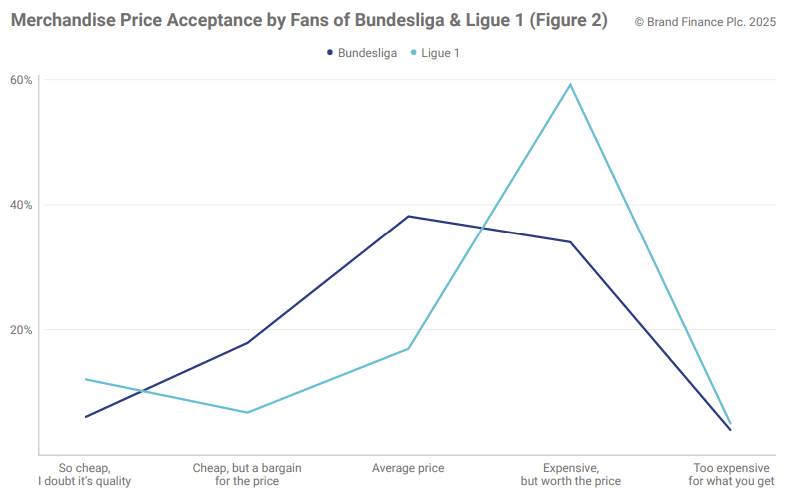

Ethics and economics: Fans pay attention

Brand Finance research also reveals a strong ethical stance among fans. A majority agree that “Purchasing counterfeit merchandise is unethical, regardless of price or convenience”, with particularly high agreement in China, Saudi Arabia, and the UAE. Yet, paradoxically, many fans in these same countries also claim to use unofficial live streams, highlighting a tension between ethical ideals and economic realities.

Meanwhile, the cost of attending live events is a near-universal concern. In countries like Australia, the UK, and the USA, over 70% of fans agree that “The cost of attending live sporting matches/events is too expensive.” This has real implications for clubs and leagues aiming to maintain stadium attendance while balancing commercial pressures.

Driving international fandom

56% of respondents agree that they follow teams based on where they grew up, whereas 19% indicate that their favourite teams are further afield. This coincides with the internationalisation of football, where global broadcasting and competition has enabled fans to connect with clubs all around the world. Over half of respondents agree that supporting a sports team abroad makes them want to go and visit that country, suggesting the influence of these clubs extends far beyond the pitch, and how they’re able to drive the economic benefits associated with football tourism.

However, one of the most widely agreed-upon statements globally is that “Politics is likely to have a negative impact on my view of both the Football Club World Cup 2025 and the Football World Cup 2026”. This sentiment is particularly strong in Brazil, the USA, Spain, France, and Portugal, where over 60% of respondents agree. This reflects growing concerns about how geopolitical tensions, human rights issues, and national policies are influencing the perception of global tournaments.