This article was originally published in the Brand Finance Football 50 2025 report

Head of Sports Services,

Brand Finance

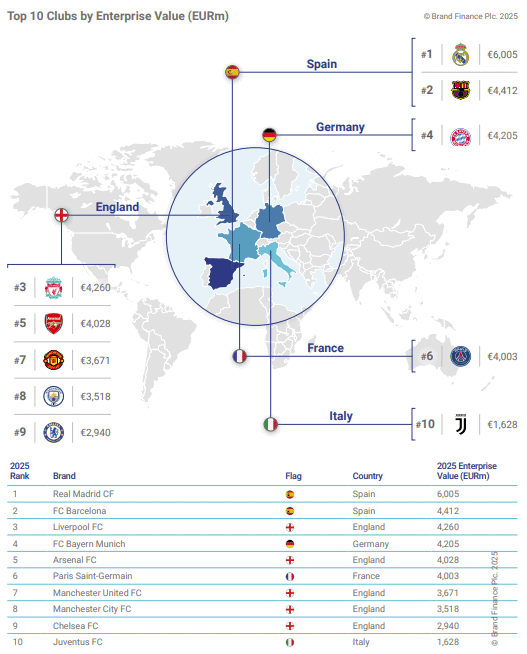

How much would it cost to buy Real Madrid?

- The Spanish Giant is both the most valuable brand and most valuable club, estimated to command a EUR6.0 billion price tag if it were to go on sale.

- Real Madrid’s enterprise value is 36% higher than the next most valuable, rivals Barcelona (EUR4.4 billion), with Liverpool, Bayern, Arsenal and PSG the others to pass the EUR4.0 billion mark.

These businesses have been valued by comparing their revenues to those of clubs that have publicly available shares and using the multiple of enterprise value to revenue for these clubs. This methodology is predominantly used in sports valuation in preference over models that derive value from the cash flows that businesses deliver to their owners – topflight clubs across Europe had a EUR0.3 billion aggregate loss in 2023 (the latest fully reported year). Valuations in transactions are usually well above income-based valuations even with optimistic future profit forecasts – this is largely attributed to the nature of clubs as trophy assets, or the hope that a buyer will pay more in the future.

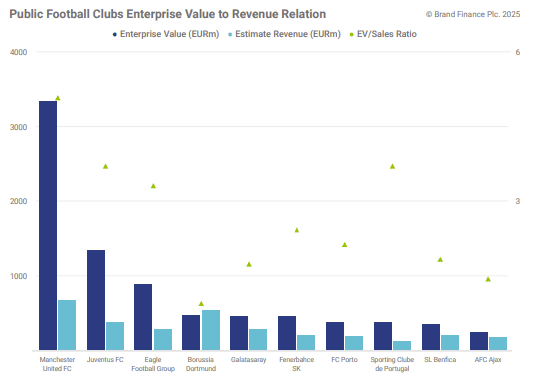

The chart below shows the current enterprise values of the top 10 most valuable publicly listed European clubs and their 2025 forecast revenue; the multiple of revenue varies widely across the data set. To calculate an appropriate multiple to apply to the revenue of an unlisted club, Brand Finance applies factors reflecting the relative performance of a club in a range of key brand and business drivers. These factors include brand strength of the club, squad value, the global following, heritage, and whether the club owns a stadium.

Real Madrid achieves its exceptional valuation due to record revenues, and the highest applied multiple: the club ranks first in the world on squad value, Brand Strength Index, heritage and amongst the top 5 clubs in global following, plus owns the Santiago Bernabeu Stadium.

On another hand, while Borussia Dortmund is one of the most successful and well-supported clubs in Europe, the enterprise value based on share price appears significantly lower than comparable clubs. Despite healthy revenues and consistent Champions League appearances, Dortmund’s EV/Sales ratio trails far behind peers like Juventus and Manchester United.

A major reason lies in Germany’s unique ownership model, known as the 50+1 rule. This regulation mandates that club members (typically fans) must retain majority voting rights, preventing full takeovers by private investors. Consequently, external investors are limited in the influence and returns they can expect, and buyout potential is capped, reducing speculative interest that typically inflates valuations in other markets. Also, the market perceives less strategic flexibility, which compresses the EV multiple.

In contrast, clubs like Manchester United and Juventus are not bound by such restrictions, and their valuations often incorporate strategic control premiums, brand commercialization potential, and ownership-driven growth.

For example, according to current share price, Man Utd’s enterprise value is below the valuation of Jim Ratcliffe’s acquisition of a minority holding, and the valuation for acquiring a controlling share would likely be higher still.